2025 series of 'Building a

Future-Ready Bank' Summits

Know More

IBSi Sales League Table 2025

Results Out Now!

IBSi Global FinTech Innovation Awards 2025

Express Your Interest!

Annual IBSi Digital Banking Awards 2025

Results Out Now!

24/7 Global Financial Technology News

Subscribe Now

FinTech insights and data portal - IBSi GalaxyTM

Know More

Cedar-IBSi FinTech Lab

A platform for global FinTechs to access the multi-billion dollar Middle Eastern market opportunity

Know MoreEverything Financial Technology

IBS Intelligence (IBSi) is the world’s only pure-play Financial Technology focused research, advisory, and news analysis firm, with a 30-year track record and clients globally. We take pride in covering 4,500+ technology vendors globally – the largest by any analyst firm in this space.

IBSi FinTech Journal

- Most trusted FinTech journal since 1991

- Digital monthly issue

- 60+ pages of research, analysis, interviews, opinions, and rankings

- Global coverage

Research

View All Reports

10,000+ pages of research, from over 30 years, covering all major Financial Technology system types, with global coverage. Our research portfolio is updated regularly and is authored with a healthy mix of primary and secondary research, led by our global teams of analysts.

Cedar-IBSi FinTech Lab

Social Media Highlights

Award Announcements

Advisory

View All Services

Our advisory offering caters to all aspects of our clients’ corporate strategy. Our teams have helped banks, consulting & investment firms for 30 years in the global Financial Services and technology world

We help our clients assess new opportunities, enter new markets, and search the best-fit partners for collaboration – all the while supporting them every step of the way via our dedicated analyst block hours

Learn More

We leverage our unparalleled knowledge and understanding of the Financial Services and technology world to help our clients with due-diligence and market intelligence mandates

Learn More

Our Growth Strategy services range from product roadmaps and price benchmarking assessments to an end-to-end strategy development via the Balanced Scorecard

Learn More

IBSi’s financial advisory practice is the brainchild of our three major and most unique strengths – our super-specialist Financial Technology focus, our in-depth knowledge on global banking and Financial Technology, and last but not least, our 30+ years of legacy and deep global relationships in the Financial Services and technology world.

Learn More

Cedar-IBSi Capital

IBSi Insights

View All Insights

Our global insights library is extensive and comes in a variety of reader and listener-friendly formats. Each piece is carefully collected, researched, analyzed and curated by IBSi’s global editorial and research teams. 24/7.

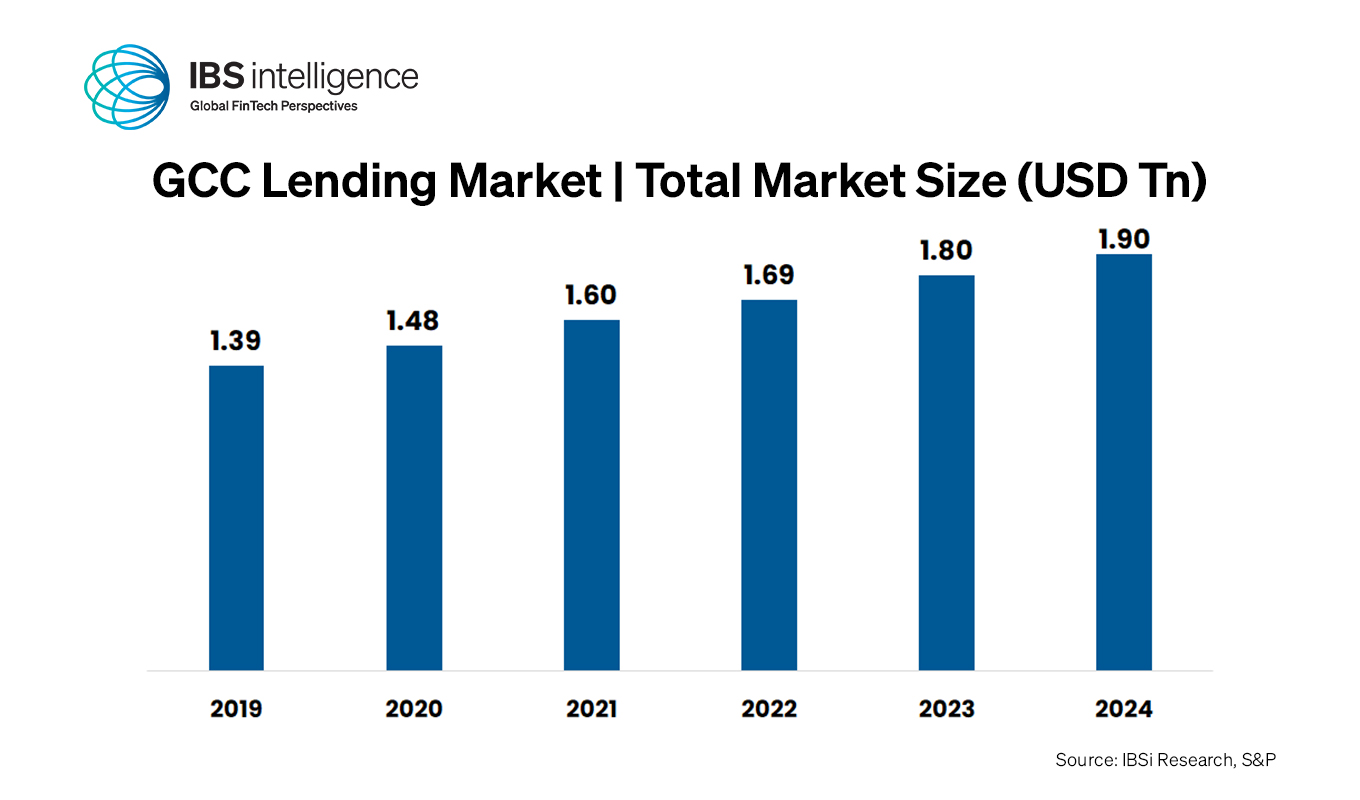

Chart of the Week

Get the IBSi FinTech Journal India Edition

Insightful Financial Technology News Analysis

Leadership Interviews from the Indian FinTech Ecosystem

Expert Perspectives from the Executive Team

Snapshots of Industry Deals, Events & Insights

An India FinTech Case Study

Monthly issues of the iconic global IBSi FinTech Journal

Attend a webinar hosted by the magazine once during your subscription period

₹200 ₹99*/month

Intelligence & Insights Portal - IBSi GalaxyTM

IBSi’s Galaxy portal is a self-service insights and intelligence portal, tracking and analyzing the global BankTech and FinTech landscape weekly. The portal comprises data points in areas of vendor intelligence, bank system intelligence, market intelligence, use-case libraries, and other forms of proprietary data and thought-leadership.

Learn MoreWhitepaper

IBSi Platforms

Our lab in the heart of Dubai’s Internet City provides global FinTechs a “soft-landing” opportunity into the MEA region. A true platform for global players to access the multi-billion-dollar Middle-Eastern market opportunity.

20+ years of being the industry-acknowledged barometer of global banking technology vendor performance. Covering 100+ leading technology participants from 150+ countries, across 20 system types. Every year.

A flagship IBSi platform that identifies and honours the most innovative global technology players and banks for their excellence in implementing technologies to foster innovation.

IBS Intelligence (IBSi) is proud to bring you the 2024 edition of the Annual IBSi Digital Banking Awards – celebrating the biggest names in Digital, Challenger, and Neo banks, along with technology players.