FinTech insights and data portal - IBSi GalaxyTM

Know More

IBSi Research

10,000+ pages of in-depth research. Covering all major banking and Financial Technology systems globally. Brought to you by IBSi’s global research team

Know More

Awards & Summit 2026

Know More

IBSi Advisory Offerings

Providing research and advisory services to help make smarter decisions for 30+ years

Know More

Cedar-IBSi FinTech Labs

A platform for global FinTechs to access the multi-billion dollar Middle Eastern market opportunity

Know More

Monthly IBSi FinTech Journal

30+ years of providing readers with their monthly dose of global FinTech news analysis, research, insights, opinions, and lots more...

Subscribe Now

Banks Recalibrate as Resilience Becomes the New Technology Mandate

Read Now

About IBS Intelligence

IBS Intelligence (IBSi) is one of the world’s leading specialist FinTech research and advisory firms. Established in the UK in 1991, IBSi has built a three-decade legacy of delivering independent, data-driven research and strategic advisory services to global technology firms, consulting organizations, institutional investors, and banks.

Through deep domain expertise and authoritative market intelligence, IBSi supports critical business, technology, and investment decisions across the global financial services ecosystem.

IBS Intelligence Portfolio

IBSi delivers a comprehensive portfolio of products and services designed to provide actionable intelligence to key decision-makers across financial services, technology, consulting, and institutional investment communities.

Since 2009, IBSi’s research platform has tracked:

- 34,000+ banking technology system purchases

- 5,000+ technology vendors

- 11,000+ banks

- Coverage across 195 countries

Our insights support diverse stakeholders:

- Technology firms seeking sharper market positioning, competitive intelligence, product strategy validation, and partnership direction.

- Consulting firms looking to deepen sector knowledge and enhance advisory quality.

- Investment firms requiring rapid industry understanding, sector prioritization, and informed valuation perspectives.

- Banks and financial institutions developing technology strategies, evaluating vendors, and implementing systems that enhance long-term competitiveness.

Intelligence & Insights Portal - IBSi GalaxyTM

IBSi’s Galaxy portal is a self-service insights and intelligence portal, tracking and analyzing the global BankTech and FinTech landscape weekly. The portal comprises data points in areas of vendor intelligence, bank system intelligence, market intelligence, use-case libraries, and other forms of proprietary data and thought-leadership.

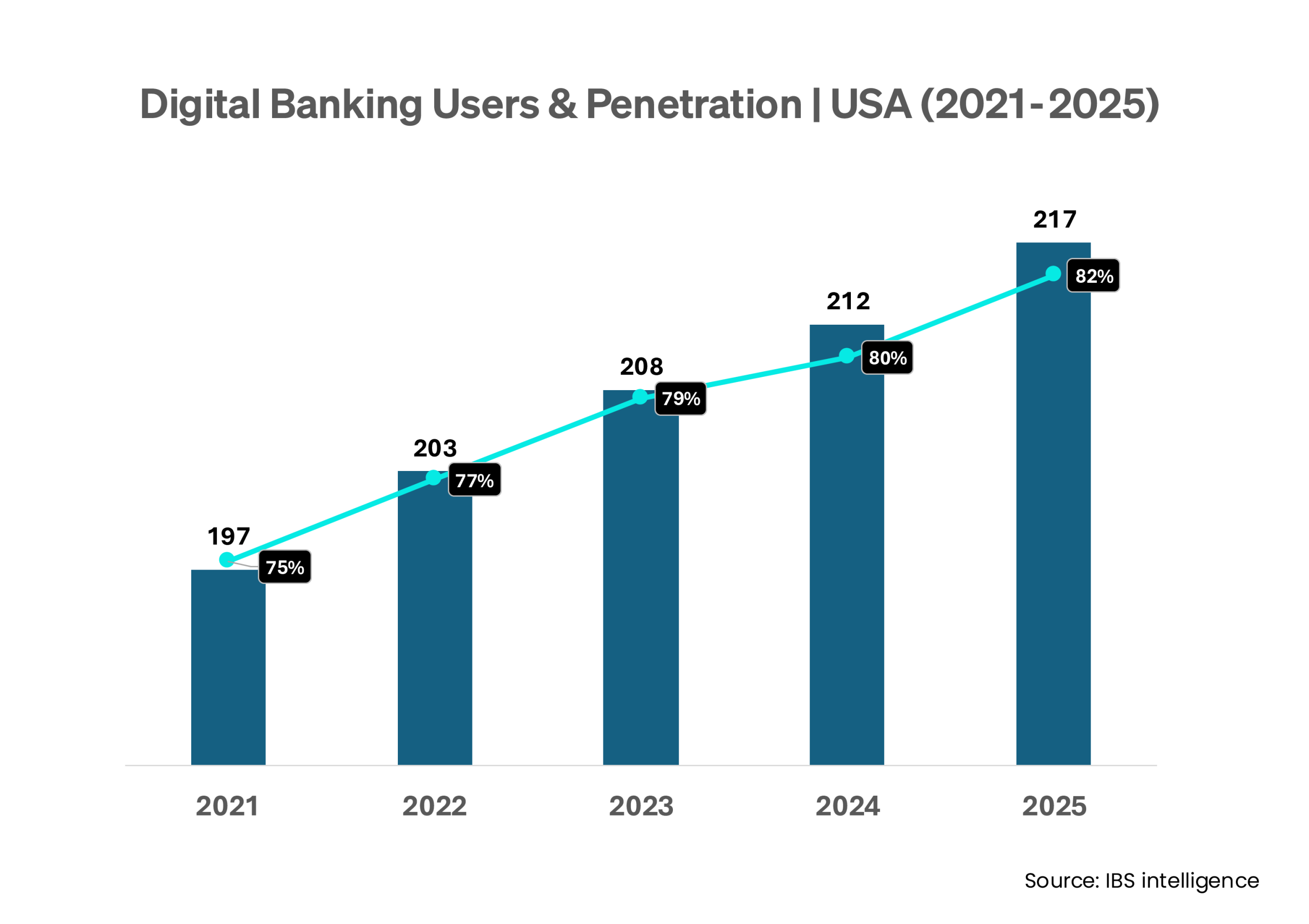

Learn MoreChart of the Week

FinTech insights exclusively curated by the IBSi’s Research Team

Research

View All Reports

10,000+ pages of research, from over 30 years, covering all major Financial Technology system types, with global coverage. Our research portfolio is updated regularly and is authored with a healthy mix of primary and secondary research, led by our global teams of analysts.

Cedar-IBSi FinTech Labs

IBSi Awards

20+ years of being the industry-acknowledged barometer of global banking technology vendor performance. Covering 100+ leading technology participants from 150+ countries, across 20 system types. Every year.

A flagship IBSi platform that identifies and honours the most innovative global technology players and banks for their excellence in implementing technologies to foster innovation.

IBS Intelligence (IBSi) is proud to bring you the 2026 edition of the Annual IBSi Digital Banking Awards – celebrating the biggest names in Digital, Challenger, and Neo banks, along with technology players.

IBSi celebrate the bold visionaries transforming the banking landscape in the Middle East, we recognize outstanding achievements in technology, digital transformation, and innovation that redefine the future of banking.

Global Summits

IBSi Advisory

View All Services

Our advisory offering caters to all aspects of our clients’ corporate strategy. Our teams have helped banks, consulting & investment firms for 30 years in the global Financial Services and technology world.

We help our clients assess new opportunities, enter new markets, and search the best-fit partners for collaboration – all the while supporting them every step of the way via our dedicated analyst block hours

We leverage our unparalleled knowledge and understanding of the Financial Services and technology world to help our clients with due-diligence and market intelligence mandates

Our Growth Strategy services range from product roadmaps and price benchmarking assessments to an end-to-end strategy development via the Balanced Scorecard

IBSi’s financial advisory practice is the brainchild of our three major and most unique strengths – our super-specialist Financial Technology focus, our in-depth knowledge on global banking and Financial Technology, and last but not least, our 30+ years of legacy and deep global relationships in the Financial Services and technology world.

Advisory Case Study

IBSi Insights

View All Insights

Our global insights library is extensive and comes in a variety of reader and listener-friendly formats. Each piece is carefully collected, researched, analyzed and curated by IBSi’s global editorial and research teams. 24/7.

Cedar Hill Capital

News Analysis

View All

IBSi FinTech Journal

- Most trusted FinTech journal since 1991

- Digital monthly issue

- 60+ pages of research, analysis, interviews, opinions, and rankings

- Global coverage