Back

Back

IPOs in the last decade have been dominated by FinTech, study shows

By Puja Sharma

Data from Tech Nation reveals that nearly a quarter of UK tech companies are making it to Series C or an exit in 2022 but warns that these large liquidity events must not detract from the need to support the majority (50%) of tech companies who are in earlier stages of growth, especially those R&D intensive firms who tend to have longer product development cycles and time to market.

Around 15% of IPOs and 13% of acquisitions have taken place in the FinTech sector

The majority of these IPOs have taken place for companies in the FinTech sector over the last decade; confirming FinTech as one of the UK’s strongest tech sectors. In addition, digital security and FinTech share the top spot for sector acquisitions over the last decade, at 13% of all acquired companies apiece.

Deliveroo, The Hut Group, and Funding Circle top the charts for IPO volume, collectively raising £1.91bn.

It is encouraging that more tech companies than ever are achieving high-quality liquidity events – particularly in sectors such as FinTech and cyber, which are helping contribute to the UK’s status as a global tech and science powerhouse. However, we cannot ignore that an even greater percentage (50%) of tech companies – particularly those focussing on developing emerging technologies – are not scaling.

If these seed and pre-seed tech firms are to grow into the scaling engines of the UK economy, the supply of capital that sustains their early growth must be prioritised, or the UK runs the risk of stifling future stars of the global tech stage. Across the entire startup ecosystem, renewed emphasis must be placed on access to early-stage funding. But this need is especially true for deep tech startups – working on cutting-edge technologies like AI and quantum computing, which fuel UK impact tech – and can require longer periods of intensive innovation at the outset of their scaling journey.

Dr. George Windsor, Research and Data Director at Tech Nation said: “We have a lot to be proud of in our tech sector, with more and more companies achieving high-quality liquidity events. We know that the UK is globally renowned for its success in FinTech, which dominates for IPOs, and although this is truly exciting news, we must not ignore the fact that an even larger percentage of tech companies are not seeing the same success. We must nurture the newest wave of UK tech companies, who are innovating to address important social, healthcare, and environmental problems. We must give these companies the support they need to achieve their full potential and shape our world for the better.”

Nearly a quarter of all UK tech companies are reaching Series C or exit

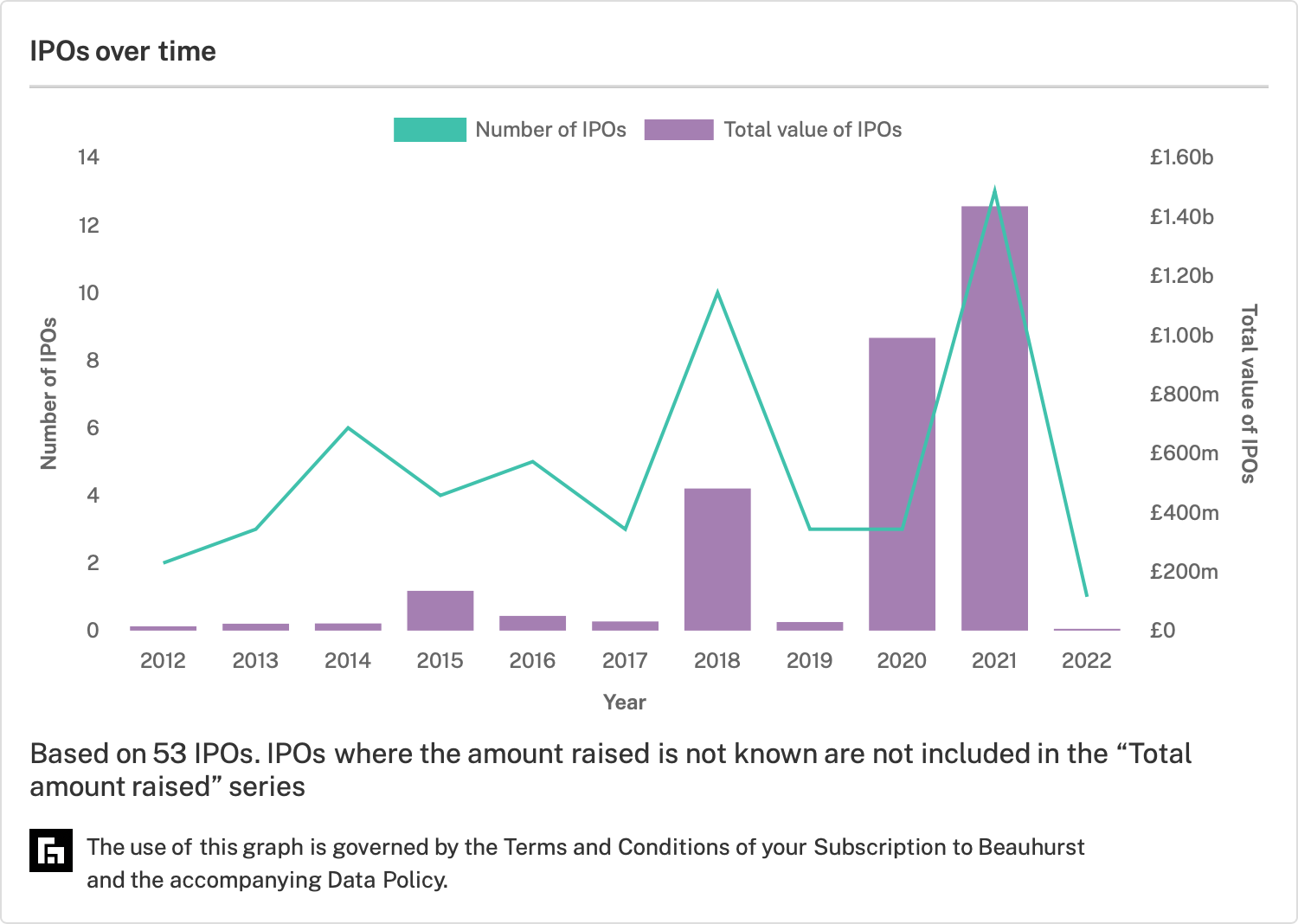

Around 23% of UK tech firms are reaching Series C or exiting; major milestones of success in a tech company’s journey. In total, 0.4% of the UK’s tech companies have undergone an IPO over the last decade. This equates to 54 IPOs over the last 10 years (with 37 of these taking place in 2021), with companies collectively raising £3.22bn to date.

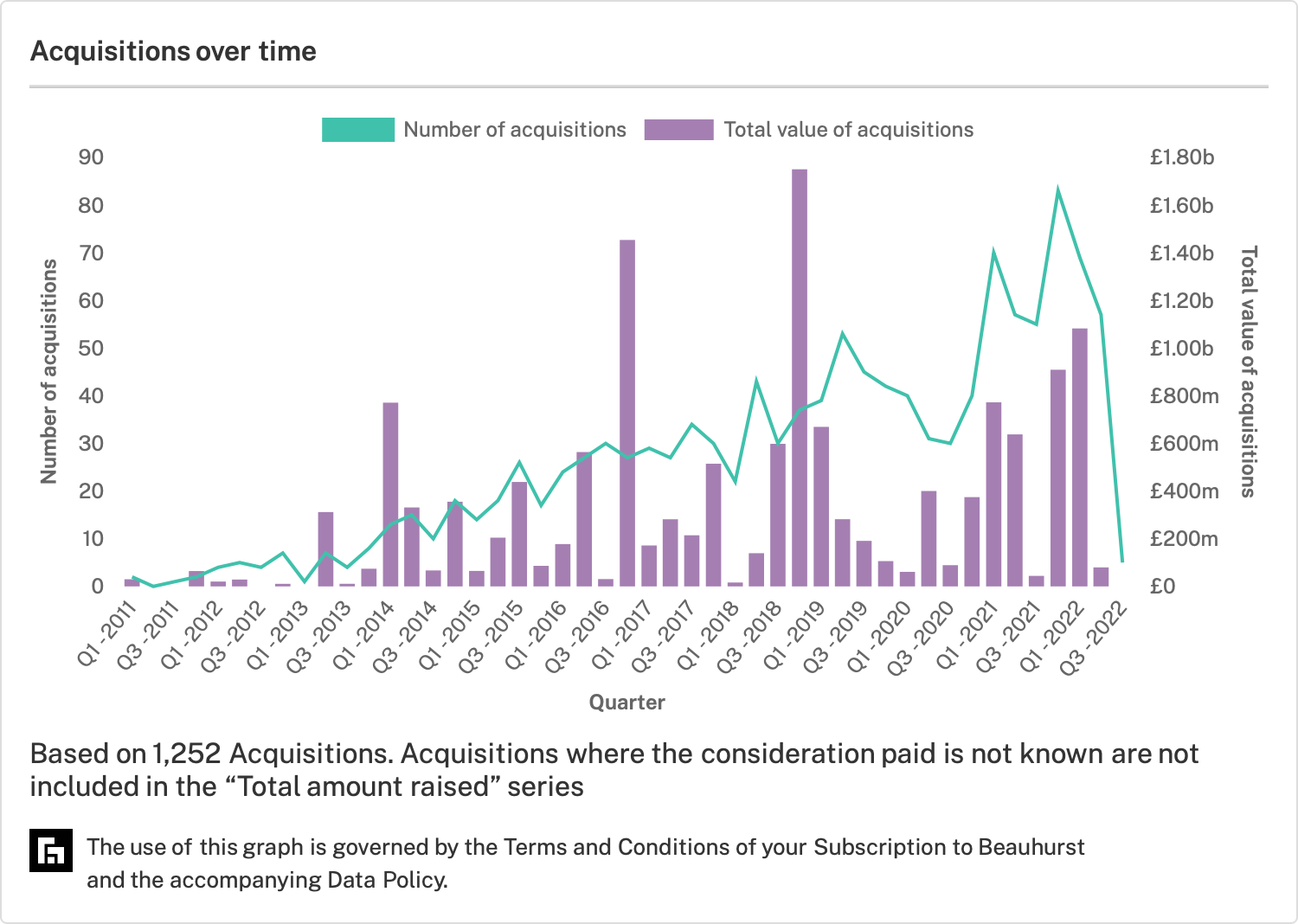

There have also been a significant number of acquisitions over the same period – over 1,200 in the last 10 years – with companies cumulatively valued at £12.5bn. Over the last decade, the number of IPOs has increased from 4 in 2013 to 17 in 2021.

Swati Lay, Chief Technology Officer at Funding Circle, said: “This research points to UK Tech’s huge potential, and the continued need to ensure fast-growing firms receive the right support at the right time. As alumni of Tech Nation’s Future Fifty Programme, we understand the importance of supporting the next generation of founders and companies as they scale. These entrepreneurs will be the technology success stories of tomorrow.”

Key Highlights

- Data from Tech Nation reveals that more UK scaling tech companies are exiting than ever before, with 23% of tech firms making it to Series C or a high-quality liquidity event in 2021.

- Around 15% of IPOs and 13% of acquisitions have taken place in the FinTech sector

- The percentage of UK tech companies reaching exit is greater than the percentage that fails, which sits at 20% in 2022.

- However, the remaining 50% of tech firms that continue operating remain at stages of low growth, employment, and investment.

IBSi FinTech Journal

- Most trusted FinTech journal since 1991

- Digital monthly issue

- 60+ pages of research, analysis, interviews, opinions, and rankings

- Global coverage

Other Related News

Related Reports

Sales League Table Report 2025

Know More

Global Digital Banking Vendor & Landscape Report Q2 2025

Know More

NextGen WealthTech: The Trends To Shape The Future Q4 2023

Know More

Intelligent Document Processing in Financial Services Q2 2025

Know More