IBSi Spectrum Report: Supply Chain Finance Platforms Q1 2025

24 Pages

As businesses continue to face increasing pressure to adapt to global market volatility, the role of Supply Chain Finance (SCF) has never been more critical. With the continued expansion of interconnected global supply chains, SCF platforms are emerging as key enablers of financial agility, empowering businesses to optimize working capital, mitigate risks, and drive resilience amid ongoing supply chain disruptions.

The Q1 2025 update to the IBSi Spectrum Report on Supply Chain Finance Platforms builds on the insights presented in the Q4 2023 edition, offering a comprehensive evaluation of the evolving landscape of SCF solutions. This updated report highlights the advancements made by leading vendors and reflects how these platforms are adapting to meet the growing needs of banks, financial institutions, and businesses in a rapidly transforming global economy.

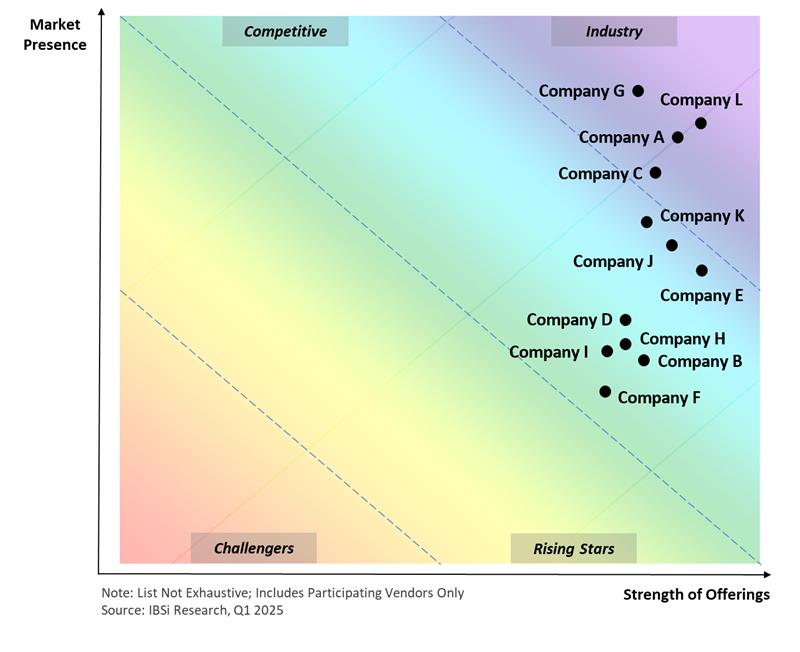

The Q1 2025 update assesses SCF platforms based on two critical dimensions: Strength of Offering and Market Presence, with a special focus on emerging trends, new functionalities, and enhanced market penetration.

- Strength of Offering: This dimension evaluates the latest capabilities, architecture, and features that have been integrated into SCF solutions. In addition the report looks at new technological innovations such as AI-driven liquidity forecasting and early warning system, generative AI, advanced risk management features, and enhanced automation that are reshaping the SCF ecosystem.

- Market Presence: This dimension assesses how vendors have expanded their reach since the last update. The evaluation considers an increased number of clients, geographic expansion into new markets, and growing recognition in the SCF space. A key focus is on how vendors are adapting their platforms to cater to the unique needs of diverse industries and geographies, including emerging markets.

IBSi Spectrum for Supply Chain Finance Platforms (Illustrative)

In keeping with the rigorous selection process, only a select group of vendors were invited to participate in this update. This process included comprehensive screenings of their technical capabilities, client feedback, and detailed requests for information (RFIs). The platforms showcased in this report have proven their ability to deliver robust solutions across different industries and geographies.

As with the previous edition, all companies featured in the report meet the essential criteria of an SCF platform, addressing diverse client needs that vary by size, geography, and complexity of solution requirements.

This update reflects the latest trends and innovations in the SCF space, with an emphasis on the growing role of technology in shaping the future of supply chain finance.

The spectrum is utilized by a range of stakeholders in the supply chain finance industry. Business and banks use it to evaluate vendors and make informed decisions during vendor selection processes. While consultants use it to guide clients, while regulators gain an overview of the competitive landscape.

- Global coverage of Supply Chain Finance Platforms

- Authored by IBSi’s research team, consisting of subject-matter-experts in corporate banking function, with inputs from SMEs from Cedar Management Consulting

- Half-yearly dynamic report updates to bring you first-hand information in a timely manner

- Complimentary 1-hour of IBSi analyst time bundled with each subscription

- Financial Institutions – CIOs, CTOs, IT, and digital transformation teams rely on our research to make the right technology selection and investment decisions

- Financial Technology companies – Founders, CXOs, product and strategy teams, use our research to stay competitively intelligent, keeping a close track of peer activity and trends globally

- Consulting firms – Research leaders and client consulting teams find this report useful to gain insights, spot opportunities, and provide clients with fact-based metrics.

- Institutional investors – Investment teams find this report useful whilst conducting thorough business and financial due diligence prior to making investment decisions

- Supply Chain Finance: A Strategic Pillar for Global Trade Resilience

- Trends and Drivers to Watch Out for in Supply Chain Finance

- SCF Solution Business Models

- Spectrum Highlights

- The IBSi Spectrum for Supply Chain Finance Platforms

- IBSi Spectrum Scorecard

- Spectrum Methodology

- IBSi Vendor Views*

- Codix

- efcom

- Finverity

- Finastra

- Intellect Design Arena

- Knight Fintech

- Lendscape

- Newgen

- Premium Technology

- Qualco

- Veefin

- Endnotes

Your subscription can be viewed in the form of a digital PDF reader and will be auto-renewed annually until cancelled.

Questions about this report? Interested in a corporate subscription to our research for your entire team? Write to us at subscriptions@ibsintelligence.com