Back

Back

Populus Financial Group launches Porte, a mobile banking solution to achieve financial freedom

By Pavithra R

Populus Financial Group, a provider of a broad range of financial products and services, has announced the launch of Porte, a mobile banking solution committed to helping members navigate a path toward financial freedom.

Populus Financial Group, a provider of a broad range of financial products and services, has announced the launch of Porte, a mobile banking solution committed to helping members navigate a path toward financial freedom.

Porte uses its smart app to reduce barriers and enable members to efficiently access their money. Porte represents a modern approach to banking by providing its members with real-world insights into their financial challenges and resources to guide them as they make informed financial decisions. It is completely dedicated to personal customer service and utilizes member feedback to develop the services, features and benefits that ensure members own their money.

“We understand and identify with the real-world financial challenges many of our members face because, just like them, we’ve been there ourselves. As a result, we are inspired and committed to help them navigate a pathway towards financial success. With up to 3.00% Annual Percentage Yield on savings, educational resources to help make informed decisions on money management and debt relief, and no monthly maintenance fees, we have built a banking experience around and for our members,” said Melanie Few, Populus Financial Group Chief Marketing Officer.

Porte app enables members to access to their money seamlessly and reliable. Among the resources included:

- 3.00% APY Savings Account on balances up to $15,000: Helps in earning up to 60x the national average, with no monthly maintenance fees.

- Financial Insights and Educational Resources: Porte is the trusted partner to provide easy-to-use tools, such as the Budget Tracker and True Debt Calculator, to help monitor monthly spending and showcase how small changes in daily spending can help reduce debt and save money.

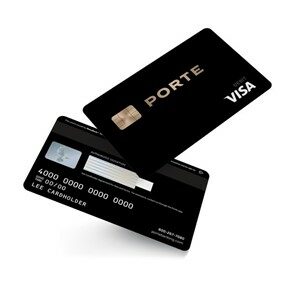

- Benefits Exclusively for Porte Members: Members can access a Porte spending account and optional savings account without a brick and mortar bank. Other benefits include: access to paychecks up to 2 days faster when enrolled in direct deposit, optional overdraft service, cash back rewards at participating retailers and real-time account alerts. Additionally, members receive a sleek and modern Porte black Visa debit card.

- Porte’s Giving Program: Through Porte’s #DoorToChange program, members shop with a purpose. With every purchase made with the Porte card, a donation is made to the Porte charity partner of the member’s choice.

“Porte’s mission is to inspire financial freedom by giving members the right tools to own their money. As a generation of Americans struggle in the maze of managing their finances and, for so many, under the burden of what seems to be never-ending debt, they need a trusted partner. Porte was built on the feedback of consumers and we are fully committed to listening to members about services, benefits and features they desire and finding ways to deliver,” added Few.

Porte accounts and services have been established in partnership with MetaBank and Netspend.

IBSi FinTech Journal

- Most trusted FinTech journal since 1991

- Digital monthly issue

- 60+ pages of research, analysis, interviews, opinions, and rankings

- Global coverage

Other Related News

Related Reports

Sales League Table Report 2025

Know More

Global Digital Banking Vendor & Landscape Report Q2 2025

Know More

NextGen WealthTech: The Trends To Shape The Future Q4 2023

Know More

Intelligent Document Processing in Financial Services Q2 2025

Know More