Back

Back

NatWest, Deutsche Bank, and 9 others trial Intraday FX Swaps solution

By Megha Bhattacharya

NatWest Group, Deutsche Bank, Bank of Ireland and Banca Mediolanum, together with treasury teams from some of the world’s other largest banks have trialled a solution for intraday FX swaps. The banks plan to support the initiative further, with live transactions expected in 2021 or early 2022. Eleven banking groups participated in the trial.

NatWest Group, Deutsche Bank, Bank of Ireland and Banca Mediolanum, together with treasury teams from some of the world’s other largest banks have trialled a solution for intraday FX swaps. The banks plan to support the initiative further, with live transactions expected in 2021 or early 2022. Eleven banking groups participated in the trial.

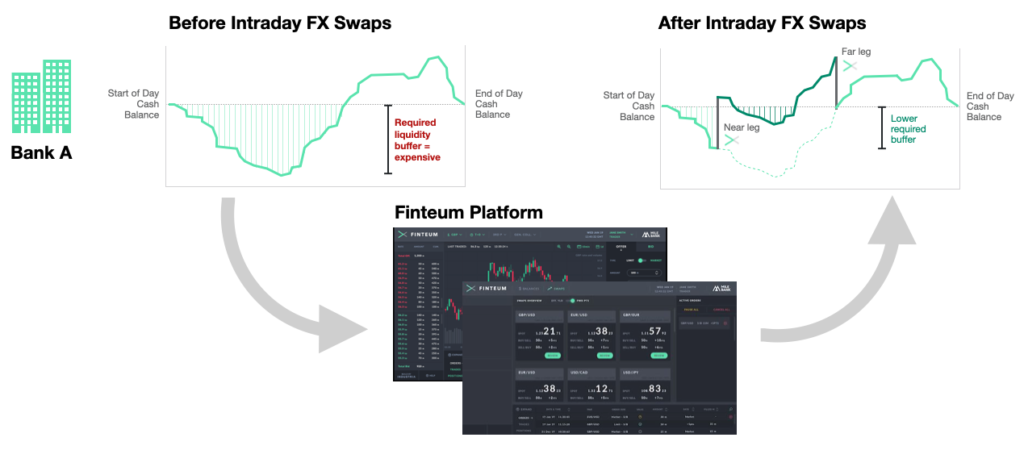

The banks’ initiative to create an intraday FX swaps market is enabled by a platform built by Finteum, a London FinTech company.

Brian Nolan, Finteum co-founder, said, “We are excited for the next phase of development. The engagement and feedback from the banks during the trial was very encouraging. It reinforces the value the initiative can offer to banks across all geographies. While every bank treasury team is focused on controlling costs, efficient optimisation of liquidity buffers is often overlooked by senior management. It is great to see the banks from the trial encouraging their peers to join the initiative and optimise the cost savings for all involved.”

An intraday FX swap involves a payment-versus-payment exchange of currency on the same day that the transaction is agreed, with a second exchange at a predefined time later that day. Using this, bank treasury teams can borrow for hours at a time, enabling them to efficiently meet a temporary liquidity need. This helps banks to optimise intraday liquidity buffers, which have been in focus since Basel III. Banks can also use intraday FX swaps to lend excess funds, representing a new revenue stream.

Over the course of one of the hour-long simulated trading sessions, the banks executed 76 intraday FX swap transactions, based on 66 orders in a central limit order book and 69 bilateral RFQs.

IBSi FinTech Journal

- Most trusted FinTech journal since 1991

- Digital monthly issue

- 60+ pages of research, analysis, interviews, opinions, and rankings

- Global coverage

Other Related News

May 27, 2025

Murex clinches 3 IBSi Digital Banking Awards for collaborations with D360 Bank and Kakaobank

Read MoreRelated Reports

Sales League Table Report 2025

Know More

Global Digital Banking Vendor & Landscape Report Q2 2025

Know More

NextGen WealthTech: The Trends To Shape The Future Q4 2023

Know More

Intelligent Document Processing in Financial Services Q2 2025

Know More