Back

Back

Majority of travellers prefer cashless transactions in APAC, study shows

By Puja Sharma

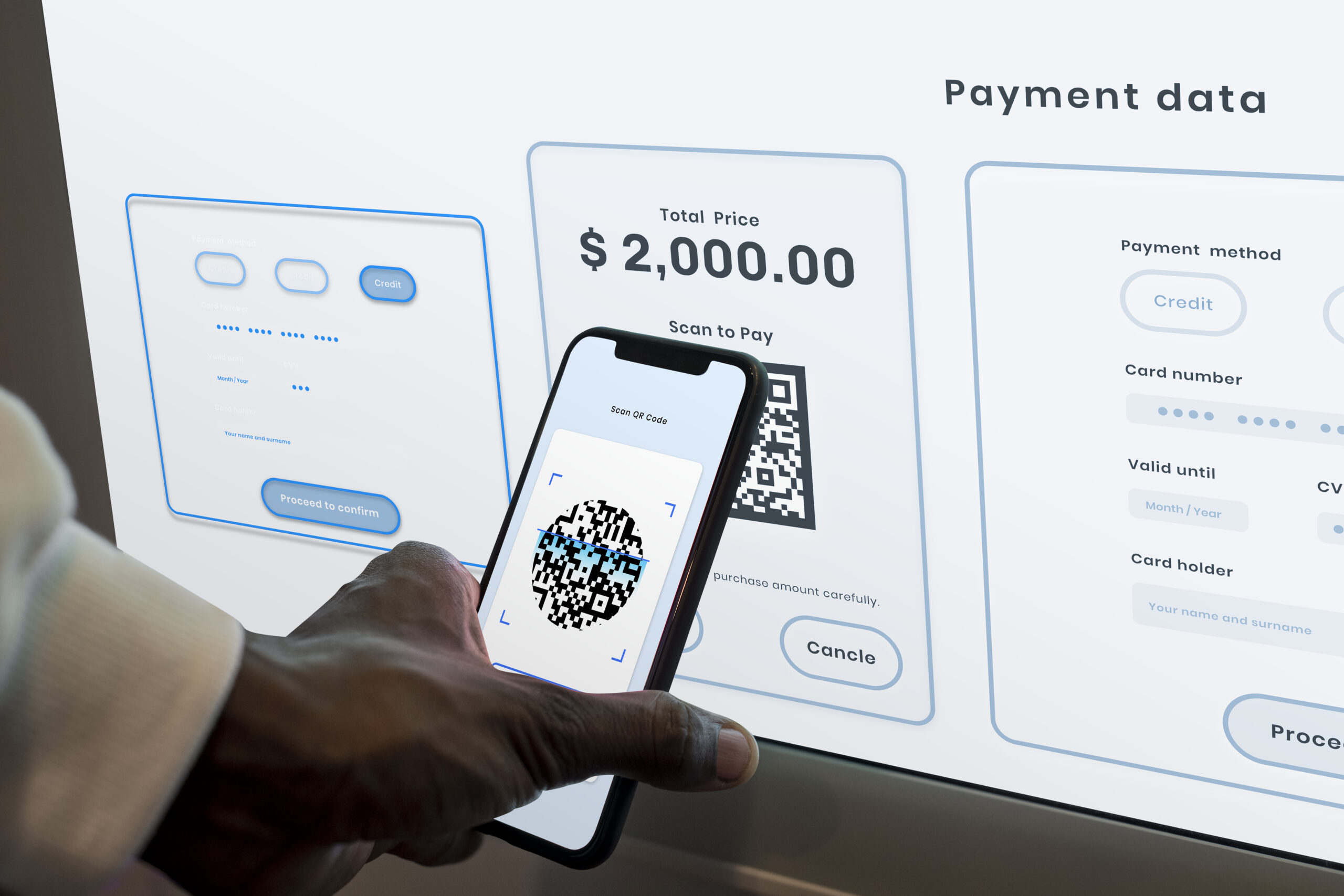

Asia Pacific travellers prefer using credit, debit and prepaid cards as payment method when travelling, according to the latest findings from Visa’s latest Global Travel Intentions (GTI) study, underlining consumers’ growing reliance on digital payment methods.

The number of travellers bringing cash on their trips has also fallen by 60% post-pandemic, with only 31% of respondents bringing cash in 2023, as compared to 79% in 2020. Respondents cite reasons such as wide acceptance by merchants, travel security and good foreign exchange rates as drivers for overseas card usage.

“We are witnessing a significant shift in travellers’ behaviours and payment preferences post-pandemic, with many opting for safe, digital, and touch-free payment methods, ” said Danielle Jin, Head of Marketing, Asia Pacific, Visa. “Our Global Travel Intentions study reaffirms the growing importance of digital payments in enhancing the overall travel experience, and how the travel ecosystem needs to help local businesses provide secure and contactless payment solutions that align with the preferences of today’s travellers.”

Understanding evolving travel trends and consumer preferences

According to this year’s study, which surveyed more than 15,000 travellers across Asia Pacific, travellers are displaying several notable trends and behaviours:

- Top destinations of choice: Japan secured the top spot among destinations that respondents travelled to the most, with 25 percent of respondents having visited the country this year, followed closely by Australia (18%) and Singapore (12%). Australia (16%), Japan (16%), and Mainland China (9%) topped the list for international business leisure, or ‘bleisure’, trips, where consumers combine leisure with business activities during their span of travel.

- Rising trip expenses: Travellers are also spending more in 2023, with an average of $2,525 per trip – a significant jump from $1,708 in 2020.

- Motivations for travel: In addition, the survey highlighted that the main motivations for travel are relaxation (39%), followed by the desire to explore and learn something new (14%) and visiting family and friends (13%). Other motivators include shopping (8%) and going on an adventure (8%).

- Sustainability takes centerstage: 63 percent of respondents indicated an interest in sustainable travel, citing choosing sustainable accommodation, utilising energy efficient modes of transport and avoiding use of single-use plastics during their trips as ways to travel sustainably.

- Inspiration for future trips: When planning future trips, travellers draw inspiration from various sources, with advertising (49%) and word of mouth (48%) leading the way. Promotions (41%), social media (39%), and travel content (37%) are also significant triggers when picking a destination and choosing activities.

Unlocking new opportunities in travel with data

For the travel industry, navigating these shifting consumer trends will be a critical part of success. Visa’s close partnerships with many players in the travel ecosystem – from travel agencies to airlines, merchants, financial institutions, and government bodies – demonstrate that it is the organisations primed with data that can better engage their travelling customers at scale with personalised, high-impact experiences.

“Visa’s data capabilities and insights provide a holistic picture of the how, where, why and who pertaining to Asia Pacific travel trends, helping organisations attract and support travellers right from the moment they decide to travel,” Jin continued. “To serve our partners better, we have also recently set up a Centre of Excellence for travel here in Asia Pacific, which is a team wholly dedicated to helping clients leverage data and maximise opportunities in the travel and cross-border payments space.”

Visa’s payments data and in-house data science capabilities can help organisations plan ahead so they can maximise opportunities when travel surges. When combined with partners’ data such as airline seat capacity, Visa’s data insights can offer predictions for peaks in travel seasons for travel ecosystem players, which consists of merchants and retailers to banks, fintechs, and government bodies in the travel space. These institutions – big to small – can use Visa’s data insights to better support their customers’ demands and preferences during peak travel periods, and chart out travel deals and rewards for Visa cardholders right when they want it.

Key highlights:

- Only 31% of travellers brought cash to their destinations in 2023, down from 79% in 2020.

- Travellers are also spending more, with an average of $2,525 per trip – a significant jump from $1,708 in 2020

IBSi FinTech Journal

- Most trusted FinTech journal since 1991

- Digital monthly issue

- 60+ pages of research, analysis, interviews, opinions, and rankings

- Global coverage

Other Related News

Related Reports

Sales League Table Report 2025

Know More

Global Digital Banking Vendor & Landscape Report Q2 2025

Know More

NextGen WealthTech: The Trends To Shape The Future Q4 2023

Know More

Intelligent Document Processing in Financial Services Q2 2025

Know More