Back

Back

Harnessing Agentic AI in Wealth Management

By Ramesh Menon, Business Architect, and Dhiraj Asrani, Product Manager, TCS BaNCS

The wealth management industry is already seeing a wave of rapid transformation through AI. One of the most visible technological interventions is robo-advisory services that leverage algorithms to provide personalised investment advice that fits individual needs, preferences, and risk appetite. Robo-advisory has democratised the investment advisory services by making them accessible and affordable to retail investors, especially attractive to younger investors who aspire for DIY or eCommerce like experience. In the world of AI-driven robo-advisors, financial planning and recommendation from a set of pre-configured models has been successfully achieved; there’s still room for improvement to manage and rebalance portfolios in real-time with changing markets.

This article highlights that the future of wealth management is human-centric, autonomous and intelligent.

Multi-agent framework

A multi-agent AI framework for wealth management utilises a team of specialised AI agents, each with a specific role to collaborate on complex tasks. The framework could be designed to provide investment strategy, real-time market data analysis, rebalancing and ensuring regulatory compliance. This collaborative system would enable highly personalised portfolio management, proactive risk mitigation and automated workflows. This framework could be broadly scaled and aligned across markets.

For example, the multi-agent framework would transcend across different investment strategies, such as passive investing, smart beta, active investing, and various sub-themes under these broad investing style or strategies, by replicating them in a consistent, systematic manner. Investors who choose an active investing strategy would be able to aspire to realise that elusive alpha.

The success of an agentic AI-based solution in Wealth Management is determined by the below factors:

- Availability of high-quality data pipeline, and accessibility

- Fine-tuned dynamic models

- Responsible AI governance

These capabilities of agentic AI framework are encapsulated in set of well-orchestrated agents that deliver high quality, consistent, reliable, and predictable outputs in the realm of rolling out hyper-personalised experiences adhering to regulatory compliance and monitoring.

Availability of high-quality data

Availability of high-quality data, which in recent past has been enabled due to digitisation and advancement in integration technologies would contribute in crafting highly nuanced, regime aware investment strategies. The data ranges from overarching macroeconomic trends, high frequency economic indicators, market microstructure and fundamental data and unstructured data such as news, sentiment data, ESG data, socio economic data should also be available and accessible.

Fine Tuned dynamic Models

The fine-tuned dynamic models refer to a collection of specialised models, which can include LLMs but also other types of Machine Learning models that are continuously updated with new data to stay relevant and accurate in a continuously fast changing market environment. Essentially, this goes beyond a single, general purpose Large Language Model and involves a sophisticated system of interconnected, constantly learning models that power the various agents within the multi-agent framework.

These models and algorithms help unearth hidden patterns in the market by analysing vast array of data, enabling quick data synthesis, extraction and prediction.

Advancements in highly available systems, offering technologies and tools enable AI techniques to simulate a myriad of investment scenarios, helping investors to assess the resilience of portfolios in various market regimes and aiding in the creation of robust, adaptable portfolios that adjust positions systematically, aligning with investor’s risk profile and objectives.

The pro-active, anticipatory approach incorporated into agentic AI framework helps with dynamic adjustments of portfolio positions to shift in market state and geopolitical events. The level of customisation goes beyond investor risk profile or financial objectives, encapsulating investor’s aspirations, ethical values and long-term vision, offering a truly holistic investment experience.

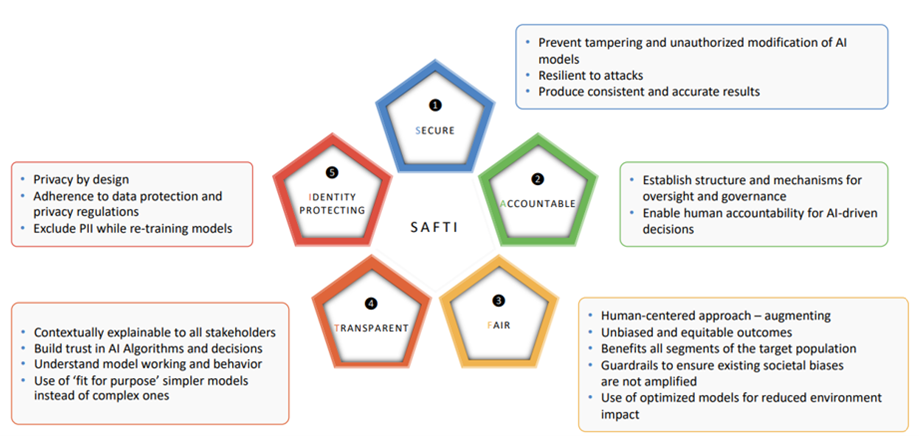

Responsible AI Governance

A responsible AI framework built around five core tenets—secure, accountable, fair, transparent, and identity protecting—can help enterprises safely unleash the potential of AI. Such a framework can be applied across the entire AI lifecycle to accelerate and de-risk organisations’ adoption of AI at enterprise scale.

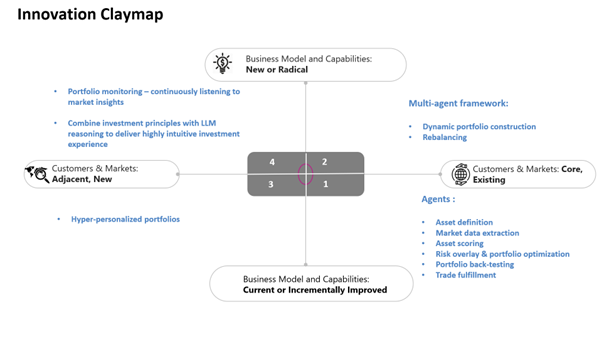

The Innovation Claymap

The Clay Map provides a full-circle view of the scope of innovation – from immediate improvements and efficiencies to blue-sky and disruptive opportunities. This model empowers organisations to strategically map out innovation initiatives based on their revenue potential and capability requirements.

Quadrant 1: Focuses on efficiency and effectiveness, comprising ‘here-and-now’ innovations that optimise current capabilities for existing markets, fortifying the core business.

The Agentic AI crew automates the integral workflows of portfolio construction activity, right from universe definition, sourcing market data for assets in the universe, screening assets, ranking assets based on selected metrics, selecting assets to be part of portfolios, overlaying customer risk preferences and objectives to optimise portfolio, back testing and stress testing portfolios to asses resilience, and setting portfolios in motion through automated trade fulfilment.

Quadrant 2: Focuses on efficiency and effectiveness, comprising ‘here-and-now’ innovations that optimise current capabilities for existing markets, fortifying the core business.

The cutting-edge multi-agent framework utilises a highly sophisticated approach by integrating dynamic portfolio construction and rebalancing with a highly adaptive risk management principle to deliver risk adjusted return to investors in a highly personalised, consistent, and systematic fashion, suiting their risk profile and investment objectives.

Quadrant 3: How might we break new ground by extending current capabilities to fresh horizons, be it new customers or market segments? Here, strategic partnerships and ecosystem integration open doors to wider accessibility and exponential growth. The multi-agent framework helps wealth management firms to offer hyper personalised portfolios at scale, suiting the unique preferences, constraints and objectives of retail Investors.

Quadrant 4: Focuses on ‘Blue Sky’ initiatives. This quadrant defines disruptive ideas that have the power to reshape offerings, providing a lasting competitive edge. The multi-agent framework can be extended to manage portfolios that constantly listen to the market and gain insights, adjusting positions at discrete intervals to ensure that the portfolio continues to align with investor’s risk profile, preferences and objectives. The Agentic AI framework integrates investment principles with LLM reasoning and delivers a highly intuitive, hyper personalised investing experience to retail investors.

Conclusion

Integrating advanced machine learning with Gen AI can impact wealth management. Financial advisors can create investment strategies that are deeply aligned with the individual needs, risk appetites, and aspirations of each client. AI algorithms can interpret complex data beyond basic patterns, including macroeconomic trends, market sentiment, and social and environmental factors.

The popularity of AI assisted portfolio construction agents stems from their success in democratising investment management experience, hitherto only available to institutional investors, by making it cheaper and more accessible to individual investors.

However, the multi-agent framework AI for portfolio construction is fraught with challenges with respect to transparency and explainability. Even though the framework has capability to enhance efficiency, scalability, sharp analysis and synthesis of investment strategies is well understood, it has its own limitations with respect to biases of models, and opaqueness.

Integrating Agentic AI workflows with human oversight is the path forward, and the industry’s ability to balance technological augmentation with human judgment will determine its success in delivering lasting value to investors.

IBSi News

Get the IBSi FinTech Journal India Edition

- Insightful Financial Technology News Analysis

- Leadership Interviews from the Indian FinTech Ecosystem

- Expert Perspectives from the Executive Team

- Snapshots of Industry Deals, Events & Insights

- An India FinTech Case Study

- Monthly issues of the iconic global IBSi FinTech Journal

- Attend a webinar hosted by the magazine once during your subscription period

₹200 ₹99*/month

* Discounted Offer for a Limited Period on a 12-month Subscription

IBSi FinTech Journal

- Most trusted FinTech journal since 1991

- Digital monthly issue

- 60+ pages of research, analysis, interviews, opinions, and rankings

- Global coverage

Other Related Blogs

March 04, 2026

AI-powered commerce and the ‘Protocols Battle’: Strategic moves for banks and businesses

Read MoreFebruary 19, 2026