Back

Back

Modern, or Merely Digital? Nigeria’s Banking Transformation Under the Microscope

By Karim BEN HAJEL, Business Development Director, Middle East & Africa, SBS

Everyone talks about digital transformation. But how much of it is truly transformation, and how much is just digitisation?

In Nigeria’s banking industry, the distinction matters. For all the progress in apps, APIs, and real-time payments, true modernisation isn’t about being online; it’s about building systems that can evolve, scale, and sustain growth. The story isn’t about who went digital first, but who’s transforming best.

Nigeria’s Shifting Digital Banking Landscape

Nigeria’s banking and financial services sector is navigating one of its most decisive transformations in decades. The traditional model, built on branches, paper workflows, and manual authorisations, is rapidly being replaced by agile, digitally powered ecosystems. Over the past ten years, reforms from the Central Bank of Nigeria (CBN) have pushed for financial inclusion, interoperability, and innovation. Meanwhile, steady improvements in internet and smartphone penetration have made it possible to serve customers through digital channels at scale.

Nigeria’s banking structure today mirrors its economic diversity. Large universal and commercial banks continue to dominate the balance sheets, yet they now operate alongside microfinance institutions, non-interest banks, and new classes of payment service banks and mobile-money operators. This pluralism reflects the market’s depth and evolving priorities.

Rise of Digital Payments and the Cashless Economy

Few areas demonstrate Nigeria’s transformation as vividly as payments. Mobile-money operators handled transactions worth approximately $47.6 billion in 2024, a major jump from prior years. The NIBSS Instant Payment (NIP) platform crossed the $770 billion quadrillion mark in transaction value for the first time.

The “cashless policy” introduced by the CBN has matured into a long-term behavioural and infrastructural reform. As smartphone adoption deepens, mobile apps have become the default interface for daily transactions. Consumers pay bills, transfer funds, and access credit without visiting branches. Agency banking has extended this inclusion into rural and peri-urban areas, with tens of thousands of agents acting as local financial access points.

Institutional Modernisation and Technology Partnerships

Behind the scenes, Nigerian banks are rewriting their technology strategies. Many are replacing monolithic legacy systems with modular, API-ready, and cloud-enabled architectures. This phased modernisation allows faster integration with FinTech partners, better uptime, and lower operating costs. Others have chosen to transform their front-end experiences, deploying digital super-apps, biometric onboarding, and AI-driven personalisation to retain customers.

Technology partners play a critical role in this journey. Institutions are increasingly relying on third-party vendors for payments orchestration, loan origination, data-risk engines, fraud prevention, and regulatory compliance modules. Preference is tilting toward partners offering local delivery, flexible pricing, and compliance with domestic data and cybersecurity rules.

Expanding Market Opportunities

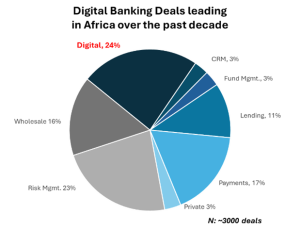

Investor sentiment and deal activity underscore the scale of opportunity. In the first half of 2024, Nigerian FinTechs attracted over $140 million in funding. The country accounts for nearly 45% of all FinTech deals in Africa, cementing its position as the continent’s largest FinTech hub. More than 200 active FinTech companies operate across segments including payments, lending, personal finance, and WealthTech.

Investor sentiment and deal activity underscore the scale of opportunity. In the first half of 2024, Nigerian FinTechs attracted over $140 million in funding. The country accounts for nearly 45% of all FinTech deals in Africa, cementing its position as the continent’s largest FinTech hub. More than 200 active FinTech companies operate across segments including payments, lending, personal finance, and WealthTech.

Digital banking’s next frontier lies beyond simple digitisation. Banks and FinTechs are exploring embedded finance models, where lending, savings, or insurance products are delivered inside non-financial platforms such as eCommerce, ride-hailing, or telecom apps. Open-banking regulations, now moving from framework to implementation, will further unlock data-driven product innovation.

The broader economic rationale is strong: Nigeria’s young, mobile-native population, combined with a persistent gap in formal credit access, creates an enormous addressable market. The next few years will determine which institutions can convert this potential into profitability.

Building a Digitally Resilient Banking System

Digital resilience, not digital reach, will define Nigeria’s banking future. As institutions scale their platforms, they must ensure continuity, security, and regulatory compliance. Cybersecurity, data protection, and system uptime have become boardroom issues. The Central Bank and NITDA (National Information Technology Development Agency) have tightened oversight on cloud hosting, cross-border data storage, and consumer-protection mechanisms.

Regulators are also promoting responsible innovation through frameworks like open banking, sandbox programs, and e-Naira testing. The goal is to enable experimentation without compromising systemic trust. Ultimately, success will depend on execution discipline. Institutions must embed digital thinking into governance, budgeting, and talent strategy, treating technology not as a department but as the bloodstream of their operations. The next generation of Nigerian banks will be those that combine data-driven insight, agile delivery, and resilient infrastructure to translate digital promise into measurable impact.

SBS to Host “Transform the Future of Banking” event in Lagos

Driving Digital Transformation and Customer-Centric Innovation SBS, a leading provider of Core and Digital Banking solutions, is set to host an exclusive event in Nigeria under the theme Transform the Future of Banking on 12 and 13 November 2025. Bringing together executives and decision-makers from across the Nigerian financial industry, the event will explore how digitalisation, innovation, and customer insight are reshaping the future of banking in Africa.

The upcoming SBS Sessions will showcase how modern banking platforms and data-driven strategies are driving operational excellence, financial inclusion, and customer trust across the industry.

Through expert presentations, live discussions, and networking opportunities, the event will explore how technology and innovation are transforming financial services — from improving efficiency to expanding access for underserved communities. Among the featured speakers is Elvis OHENEBA, Acting Managing Director of Advans La Fayette Microfinance Bank and a valued SBS customer who will share practical insights on how technology and data are transforming inclusion and small business empowerment.

With digitalisation redefining the future of financial services, the SBS event offers a unique opportunity for Nigerian banks, fintechs, and microfinance institutions to share experiences, exchange ideas, and co-create the next wave of innovation.

IBSi News

Get the IBSi FinTech Journal India Edition

- Insightful Financial Technology News Analysis

- Leadership Interviews from the Indian FinTech Ecosystem

- Expert Perspectives from the Executive Team

- Snapshots of Industry Deals, Events & Insights

- An India FinTech Case Study

- Monthly issues of the iconic global IBSi FinTech Journal

- Attend a webinar hosted by the magazine once during your subscription period

₹200 ₹99*/month

* Discounted Offer for a Limited Period on a 12-month Subscription

IBSi FinTech Journal

- Most trusted FinTech journal since 1991

- Digital monthly issue

- 60+ pages of research, analysis, interviews, opinions, and rankings

- Global coverage

Other Related Blogs

January 27, 2026

FinTech and digital transformation: Why women will shape the next era of finance

Read MoreJanuary 22, 2026