FinTech insights and data portal - IBSi GalaxyTM

33,000+ banking system deals | 11,000+ banks covered | 4,500+ vendors profiled | Across 195+ countries

FinTech insights and data portal - IBSi GalaxyTM

Proprietary data portal, tracking and analyzing the global BankTech and FinTech space, DAILY

FinTech insights and data portal - IBSi GalaxyTM

Fill a form on this page for a free demo of GALAXY

For over 30 years, IBS Intelligence has covered the global BankTech and FinTech landscape in-depth, providing actionable insights to global Financial Services, Technology, Consulting, and institutional investor groups.

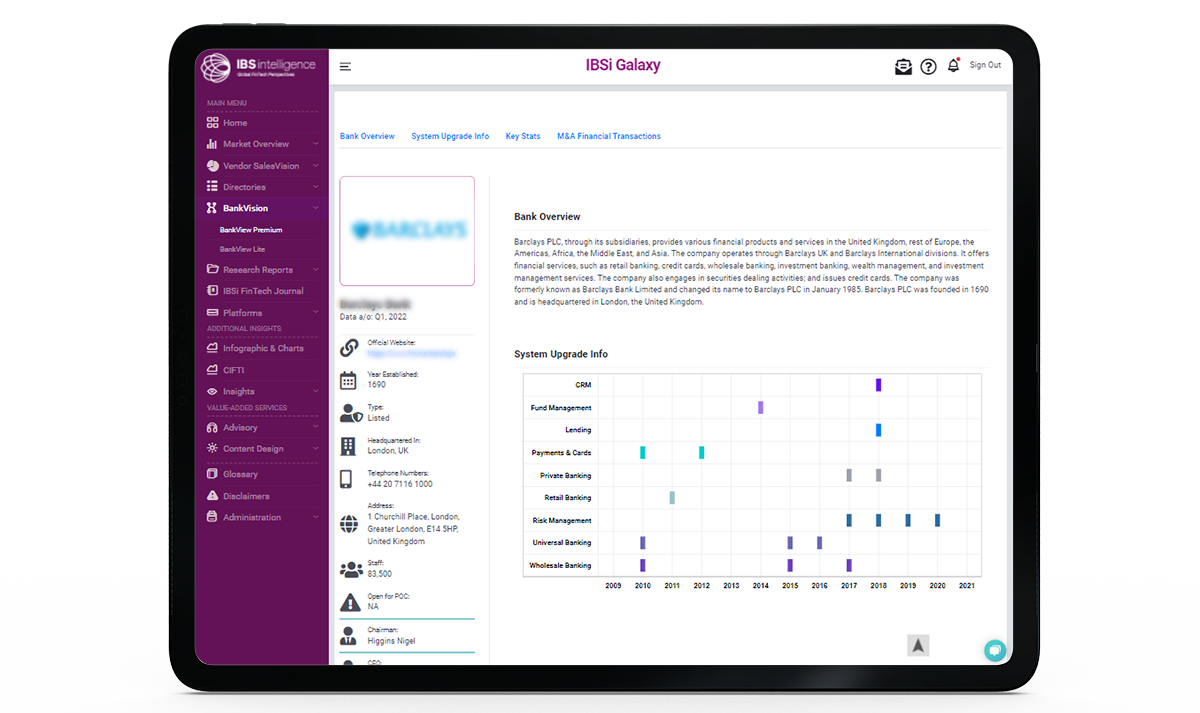

IBSi’s Galaxy portal is a self-service insights and intelligence portal, tracking and analyzing the global BankTech and FinTech landscape weekly. The portal comprises data points in areas of vendor intelligence, bank system intelligence, market intelligence, use-case libraries, and other forms of proprietary data and thought-leadership.

The IBSi Galaxy portal is a self-service portal for subscribers is updated daily and dynamically by IBSi’s dedicated global research team, consisting of experts in the space.

IBSi Galaxy provides a fairly comprehensive coverage on banking software contracts signed globally with third party service providers. The database is easy to navigate with multiple visualisations and dashboards

- Director, Big4 Audit & Consulting Firm

IBSi Galaxy is a resourceful portal, to strengthen our market and competitive intelligence. The data within helps in keeping our teams up to date. IBSi Galaxy has been helpful to our sales team for developing efficient sales tactics.

- Jalpa Shah, Marketing Director, Tagit Pte Ltd

Thought Machine has made key in-roads with banking clients around the world. IBS Intelligence’s IBSi Galaxy has contributed to this growth by providing us with the information and data required to help us navigate into different territories with market and competitive intelligence. The portal has provided insights into deals which have helped guide our sales, expansion and growth strategies.

- Verity Myers, Chief of Staff, Thought Machine

Sopra Banking Software is a subscriber of IBSI’s proprietary platform – IBSi Galaxy that provides an insightful view of banking technology deals across geographies. This digital platform is unique to the financial technology space and provides valuable information to our market intelligence and competitive analysis.

- Antoine Allemeersch, Senior Manager - Analysts relations & Market Intelligence, Sopra Banking Software

Features and data

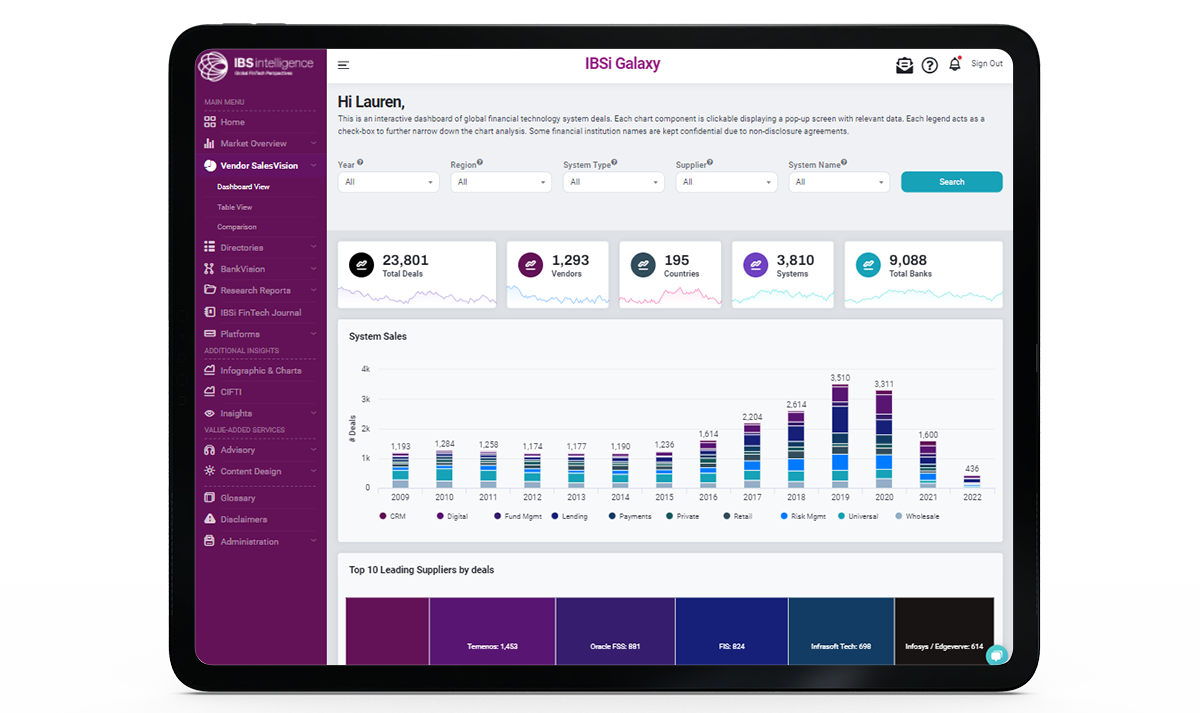

- Comprehensive module that tracks exclusive data of global banking technology vendor system sales and implementations. This module provides subscribers access to 33,000+ deals across 4,500+ global technology vendors, 11,000+ banks, covering 195+ countries since 2009

- Compare vendors and cut and slice data as per your focus areas

- Birds-eye view into the real-time banking system architecture of 11,000+ global banks, including key financial statistics, relevant IT leadership team members, system upgrade information and lots more

- Comprehensive proprietary BankTech and FinTech directories covering the global landscape

- In-depth vendor profile coverage of over 700+ vendors, covering key information such as their product suite, customer list, use-cases, and lots more

- An exhaustive directory of 4,500+ global FinTechs, consisting of key facts along with product and client information

- Proprietary IBSi PE/VC FinTech deal tracker consisting of 4,000+ deals, covering weekly happenings in the global investing space

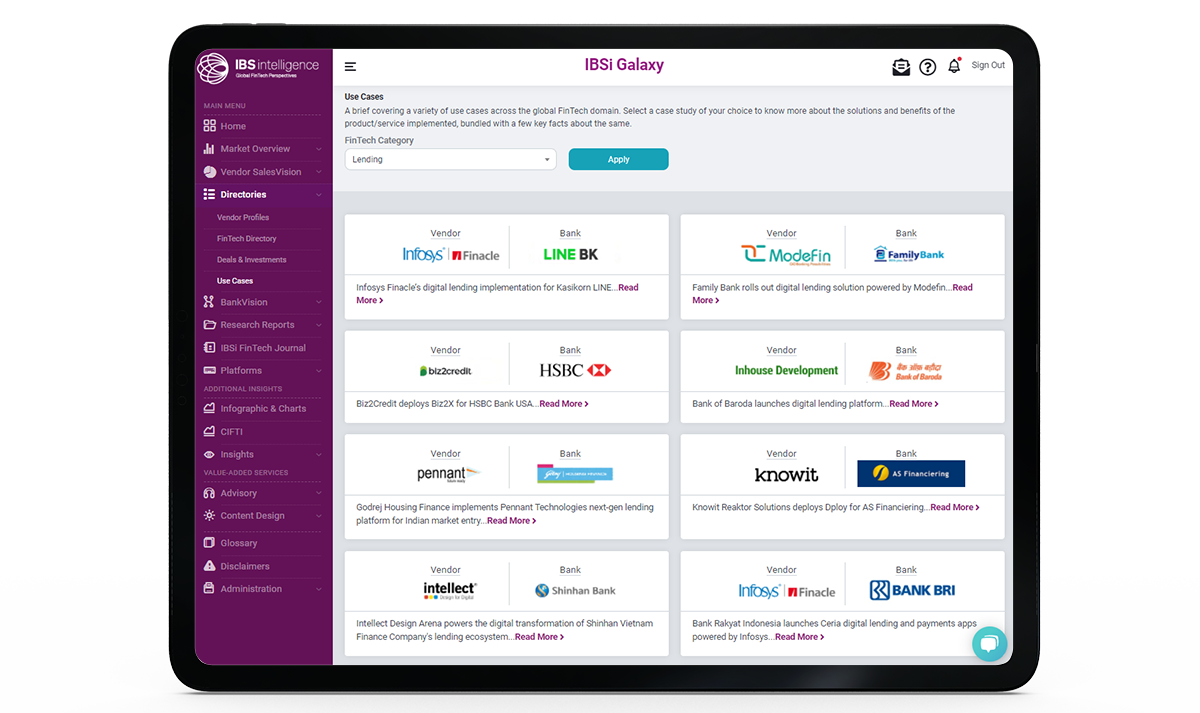

- 100+ use cases of global FinTech vendors, authored and validated by IBSi’s research team

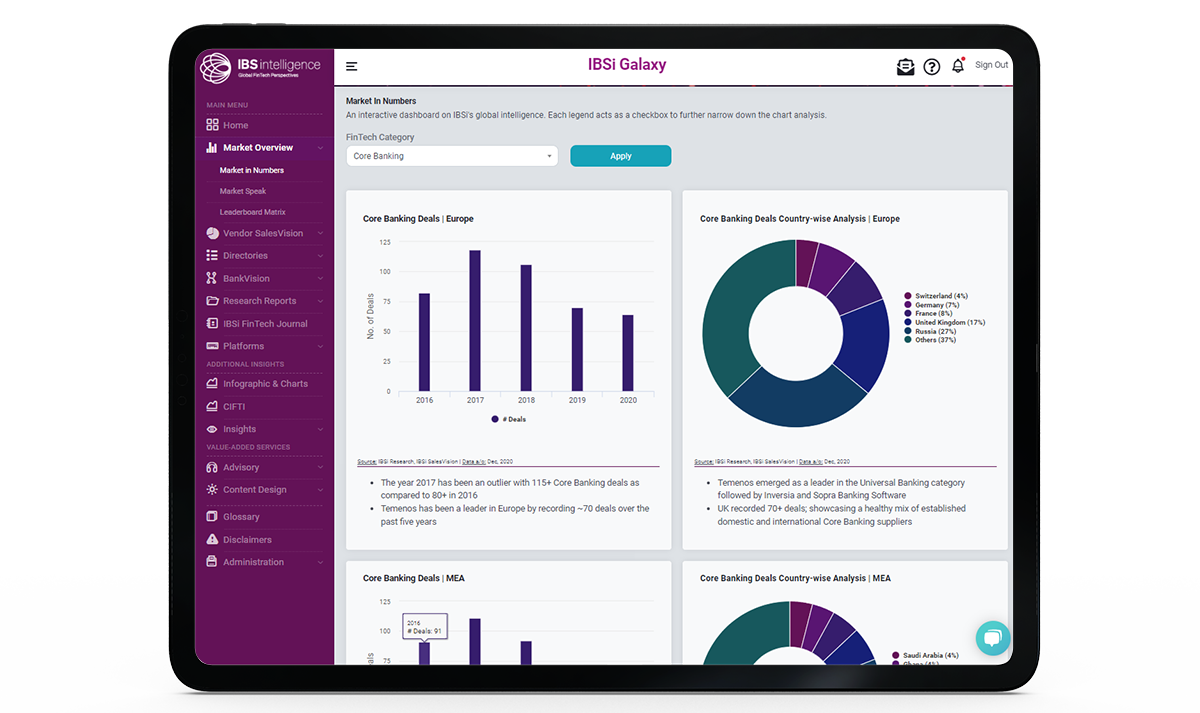

- A holistic view on all the latest trends and events across the financial technology world, presented through 250+ charts

- An IBSi-authored market commentary of the global financial technology sector, comprising regulations, threats, trends, and lots more

- Get access to monthly editions of the iconic IBSi FinTech Journal – the go-to place for technologists looking to build competitive intelligence, bankers looking to define their IT strategy, management consultants looking to make their clients smarter, and institutional investors who are seeking to make high-return investments

- The IBS Intelligence Annual Sales League Table (SLT) is the industry-acknowledged barometer of global banking technology vendor performance

- Single-point repository assists in comparing the performance of various system types from a global perspective

- Gain insights on ~24,000+ vendor deals across 2016 – 2025 covering the globe

- A constant hourly feed of IBSi news with global coverage. Brought to you by IBSi’s editorial team.

- Elevate your thought leadership quotient via IBSi whitepapers, webinars, analyst views, and more

- Explore Cedar-IBSi’s proprietary FinTech indices and compare them against market indices from around the world

- Become a member and get access to our state-of-art digital infrastructure in the Cedar-IBSi FinTech lab, based in Dubai.

- Chat with an IBSi analyst directly via the live chat feed within the portal

- Much more….

-

33,000+

system sales records. Growing everyday...

-

11,000+

global banks covered

-

4,500+

vendors profiled

-

195+

countries covered

-

100+

analysts updating GalaxyTM with fresh research

Key client personas and their uses

- Gain competitive intelligence on which BankTech vendors and systems are selected by your banking peers and what’s trending

- Learn about the sales and implementation history of specific BankTech players and geographies, before you make your investment decision

- An aggregation of global insights in the form of in-depth vendor profiles, use-case repositories, market reports, annual rankings, leaderboards, and lots more

- An important portal for your bank’s vendor evaluation and selection process

- Get access to in-depth trends, data, insights to aid in the research of your Financial Services consulting programs

- Assist your banking clients on technology supplier evaluation engagements by using the portal’s in-depth vendor intelligence modules

- Lead generation for potential strategy design and project management mandates from global banks

- Gain competitive intelligence on the sales of your peers and which geographies to focus on

- Lead generation possibilities – know a bank’s upcoming technology replacement cycle and know when to begin conversations

- Identify market gaps and opportunities and plan your growth strategies

- Gain insights to aid your sales, marketing, product, and strategic efforts via a vast library of thought-leadership and insights

- Source global investment targets and gain exclusive insights to their performance

- Identify white spaces and opportunities in your fund portfolio by tapping into various forms of insights in the tool

- Strengthen your valuation models by studying sales patterns of a vendor and it’s peers

FAQs

IBSi has a dedicated team of global FinTech researchers and consultants, each with specific FinTech area experience, who, along with the editorial team, conduct primary and secondary research daily. By virtue of being an “Analyst firm”, a lot of this data is collected in the form of primary conversations that our teams regularly conduct with global BankTech and FinTech vendors.

IBSi Galaxy covers banking systems sales made to financial institutions across the globe, classified under 16 categories, including Universal Banks, Retail Banks, Commercial/Wholesale Banks, Private Banks, Digital-only Banks, Investment Banks, Community Banks, Central/Regional/Development Banks, Microfinance Banks, Credit Unions, Insurance, Investment Services, Lending institutions, Microfinance Institutions, Payment Institutions and Stock Exchanges. Non-financial institutions are beyond the scope of this database.

Most subscription plans require a subscriber to sign up annually, with the option of single-user access or an enterprise subscription which provides multiple user logins. While most of the data is not downloadable, the portal allows the user to perform various analysis using visual dashboards, data tables and more.

Most of IBSi Galaxy’s modules are refreshed either daily or weekly by IBSi’s analyst team. Updates are highlighted in the form of a notification bell on the top right of the navigation bar.

The system scope of IBSi Galaxy is spread across 10 banking technology and FinTech areas, covering Universal banking, retail, wholesale, private banking, lending, risk management, payments, investment & fund management, digital channels and CRM systems.

Trending In Research

Latest News Analysis

UK banks accelerate payments revamp with big new budgets

Read More

UniCredit taps Wise to power international payments

Read More

Cathay United opens private bank in Kaohsiung

Read More

EximPe secures RBI cross-border payments licence

Read More

UK SMEs stuck in verification gridlock as FinTech lags behind

Read More